By Administrator_ India

The benchmark indices logged a fresh high on Tuesday since the global outbreak of Covid-19 after gaining sharply for the fourth straight day. Stocks extended gains on optimism around the US stimulus and a positive outlook given by India’s largest housing finance firm.

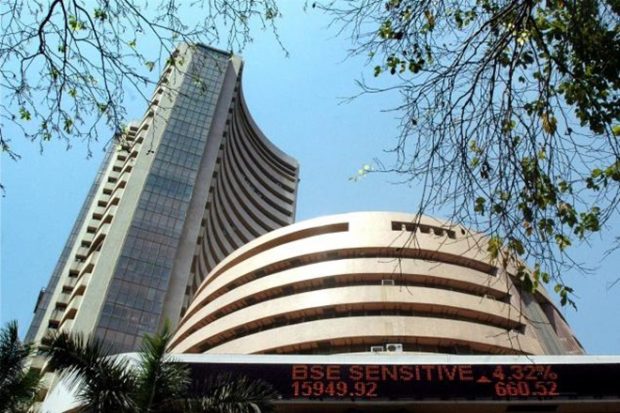

The Sensex rose 601 points, or 1.54 per cent, to end at 39,574 — the highest since February 27. The Nifty 50 index rose 159 points, or 1.4 per cent, to end at 11,662. Both benchmark indices have rallied over 7 per cent and posted gains in six of the past seven sessions.

In an exchange filing, Housing Development Finance Corporation (HDFC) said its loan business has improved in the second quarter. According to the filing, HDFC’s loan disbursements during the September quarter were at 95 per cent of the level in the corresponding quarter last year.

Shares of HDFC rose 8.4 per cent. Other HFCs also posted strong gains — GIC Housing Finance rose 12.3 per cent, LIC Housing Finance jumped 5.2 per cent, and Repco Home Finance hit an upper circuit.

Experts said investors are lapping up any green shoot in the economy.

The India Services Business Activity Index, compiled by IHS Markit, stood at 49.8 in September, against 41.8 in August. It rose for the 5th straight month. With the manufacturing activity improving, the Composite PMI Output Index rose to 54.6 in September, from 46 in August.

More than 150 stocks hit their 52-week highs, and 287 stocks were locked in the upper circuit on the BSE. The market breadth was positive with total advancing stocks at 1,512 and those declining at 1,196 on the BSE. Finance and Realty stocks rose the most, and their gauges gained 3.04 per cent and 2.4 per cent, respectively.