By Administrator_ India

The markets fell sharply on Thursday amid a global sell-off in equities as hopes of reaching a stimulus deal before the US presidential election diminished. Also, rising Covid cases and tightening restrictions in Europe clouded sentiment.

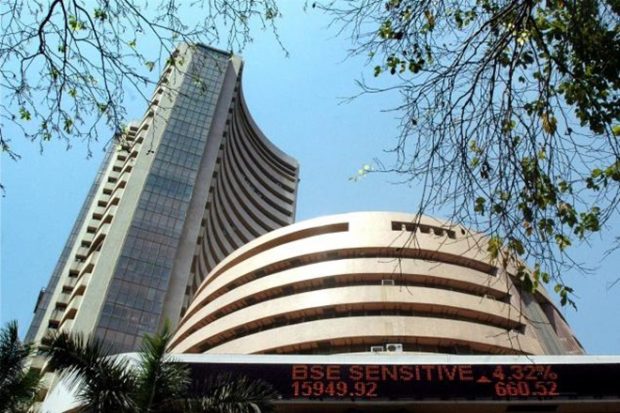

Snapping its 10-day winning streak, the Sensex closed at 39,728, down 1,066 points, or 2.6 per cent, while the Nifty fell 291 points, or 2.4 per cent, to end at 11,680.

It was the biggest single-day fall for the benchmark indices since September 24 and fifth-biggest decline in this financial year.

“The market reacted to the probability of a US stimulus getting pushed beyond the presidential election and concerns about Donald Trump’s prospects. Also, the second round of lockdown in key European countries weighed on sentiment,” said Prasanna Pathak, head, equity, Taurus Mutual Fund.

Banking and financial stocks — the major drivers of the latest rally — saw the maximum selling.

IT stocks too went into reverse and traded lower as investors locked in gains in a sector that has helped drive a rally in the broader market so far this month.

Most global stocks dropped on the same count as in the Indian markets. In the past three weeks, the markets had rallied 10 per cent.

The hopes of the US Congress passing a stimulus package waned after Treasury Secretary Steven Mnuchin on Wednesday said something done on the stimulus package before the election and executing on that would be difficult. “A deal before the elections seems unlikely, and investors are worried,” said Andrew Holland, chief executive officer, Avendus Capital, Alternate Strategies.

The rising pandemic cases in Europe added to investor worries. Infections in Germany and Italy are rising, and several countries have imposed stricter measures to contain the disease. Stalled vaccine trials and Brexit clouds also affected sentiment. Both overseas as well as domestic investors were sellers in Thursday’s trade. The former sold shares worth Rs 604 crore, while the latter yanked out Rs 808 crore.